You may have heard of the term Sinking Fund. But what exactly is a Sinking Fund, a Sinking Fund is an effective way to save up for large expenses.

In this guide, we’ll unwrap what a sinking fund is, how it works, and how it can transform your approach to managing your money.

What is a Sinking Fund?

Simply put, Sinking Funds are a simple and effective way to save up for large expenses.

Imagine this: You’re planning an awesome family vacation. Instead of wondering how you'll afford it, you’re relaxed, because you have been setting aside a small portion of your income each month specifically for this trip.

Sinking funds are a great way to save up for big expenses without disrupting your monthly budget or dipping into savings. For example:

Car Maintenance :

Save monthly for new tires or regular maintenance.

Holiday Spending:

Set aside funds for Christmas gifts throughout the year, so you're ready for the holiday season without stress.

Travel:

Dreaming of a getaway? Plane tickets and travel expenses are covered with a travel sinking fund, making that dream vacation a reality.

Back-to-School Costs:

Think about shoes, stationery, textbooks and school uniforms, all these back to school expenses that add up. Saving up a little each month can ease this burden.

Special Occasions:

Whether it's a special outfit for an event or gifts for a birthday party, a sinking fund helps you prepare for these extra expenses.

Benefits of Sinking Funds?

By breaking down a large expense into smaller, manageable pieces, you’re less likely to be overwhelmed or disrupt your monthly budget and dip into savings.

A Sinking Fund can help you:

- Reduce Stress by being prepared for future expenses.

- Promotes healthy budgeting habits by encouraging consistent saving towards specific goals.

- Create a sense of accomplishment when you see your fund grow keeps you motivated.

How to Create a Sinking Fund?

Now that we know what sinking funds are, how they work, and why they are beneficial, here’s how to create one in four easy steps.

Step 1: Identify Your Goal

First, determine what you're saving for. This could be anything from a vacation, home repairs, to annual insurance premiums. The key is identifying expenses that aren't regular but are expected or inevitable.

Step 2: Calculate how much you need to save

Once you've identified your goal, calculate the total amount needed. Then, divide this total by the number of weeks or months until you need the funds. This will give you the amount you need to save in each period.

For example, if you're saving for a $1,200 expense in 12 months, you'll need to save $100 each month.

Step 3: Choose where you will store your sinking fund

Decide where to keep your sinking fund. Our Sinking Fund Budget Binders are perfect for this! They help you organise and keep track of your money for different sinking funds savings goals, making it easy to see how much you've saved and keep you excited about reaching your targets.

Step 4: Add Your Sinking Fund to Your Budget

Make sure to include your sinking fund in your monthly budget. Think of it as a regular bill that you must pay every month. Make sure to set aside a little money for it each month, just like you do for your other important bills.

How Many Sinking Funds Should You Have?

Now that you know all about sinking funds, it's tempting to create one for every expense. But too many sinking funds can slow down your progress. After all, there's only so much money you save each month.

Depending on your financial goals, it's better to focus on a few key priorities at a time. Let me break it down.

Imagine you have $300 to split among four sinking funds:

- $50 for Clothing

- $100 for Vacation

- $100 for Car Maintenance

- $50 for Medical Expenses

By focusing on a few key areas, you'll make more significant progress towards your savings goals.

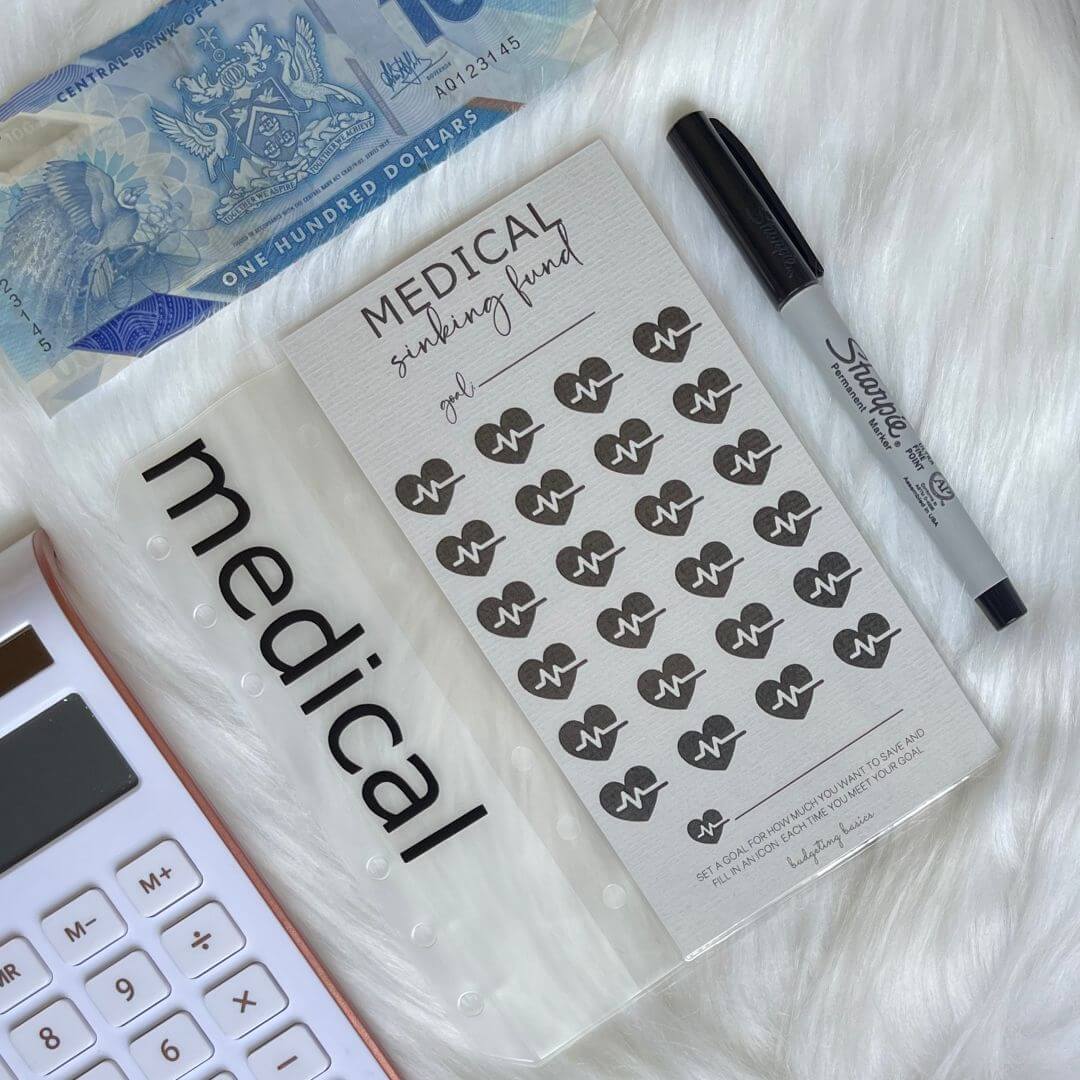

Make Saving Easy with our Sinking Fund Binder

Think of our Sinking Fund Binder as your budget's secret helper. This budget binder will help you prepare for future expenses, like a vacation, car repairs or medical expenses. Our Sinking Fund Binder can be customised with 6 sinking funds of your choice, each sinking fund includes 1 customised cash envelope and 1 budget sheet.

Our Sinking Fund Saving Trackers are fun and easy to use. Simply determine how much you would like to save

Example:

Let’s say your goal is $1200. $1200 ➗ 30 icons = approx. 40 per icon

Each time you reach your goal and place your cash inside the envelope and watch your savings grow!

Laminated trackers are reusable and permanent markers can be removed with an alcohol wipe or acetone.

Sinking funds are another great way to save because they are simple and they really work. You save a little bit every month for different things you need and this keeps your budget safe and helps you build a good habit of saving regularly!